I’ve never been a CFO, but I’ve known and worked with more than a few – some have been friends – and one is a current colleague, Ted. Ted’s a great guy. Humble, unassuming, smart, and intimidating in a friendly way. I think Ted and all the CFOs I’ve known might see themselves in this list below.

Spoken in the voice of a typical CFO…

I’m a fan of:

• Spreadsheets

• Making money for the company

• Positive cash flow

• Comfortable profit margins

• Not losing money for the company

• Spending it when I understand how it can bring structural value

• Skepticism for all quick pitches that sound like they were first imagined in the days of Mad Men but appear to simply be updated by unoriginal people for the TikTok age

• Intelligent investing

• Minimizing risk

• Making sure my company stays solvent

• Staying out of jail

So why do we have the reputation for being difficult? If you work in the same company as me, just make sure all those things that are on that list are true or come true. Especially now that there’s a lot more scrutiny of the financial health of companies, our voices are being heard and our opinions more heavily considered. And usually, our opinions are centered on a subject I’m a fan of (which I didn’t include on the list because I wanted you to take special notice of it). I didn’t include math as something I’m a fan of, but you probably should’ve assumed it. I’m a fan of math because to me it’s all about gravity. What goes up, comes down. Unless you add more fuel at the right time and in the right places. Think of me as the fuel guy.

Anyway, let’s focus on Customer Success professionals and their current angst around talking with the CFO. You didn’t think I noticed? Of course, I noticed. Who doesn’t notice when the key customer-facing teams are in a quandary about how to handle budget cuts? I care about customers as much as anyone and cutting service to them introduces risk for them. But not cutting the budget introduces risk for us. This should lead us all to the conclusion that we need to work together. But we have to start from a common point of understanding that there is only so much money available.

So, I want to help. When you come to me with a budget request, make sure it addresses a few basic questions. Make it clean by asking yourself:

1. How much of a delta to my existing budget are we talking about?

2. How will the money solve a particular company problem?

3. Have I prioritized all the areas of my practice to determine what’s indispensable?

4. What research have I conducted to support my claim of need and of solution?

5. How do I intend to measure whether the problem is solved?

6. How will I ensure that during the course of solving the problem, I am not exposing the company to new risk?

7. How can solving the problem create new opportunities for company revenue growth?

As a CFO, I try to keep my life simple. Reduce risk while making money. A contradiction? I don’t think so. Keep in mind that raising the budget usually increases risk. So, if you can reduce risk and maintain budget, you’re getting my attention. Or if you can increase revenue while introducing only marginally more risk via a larger budget and the former outweighs the latter, you have my attention too.

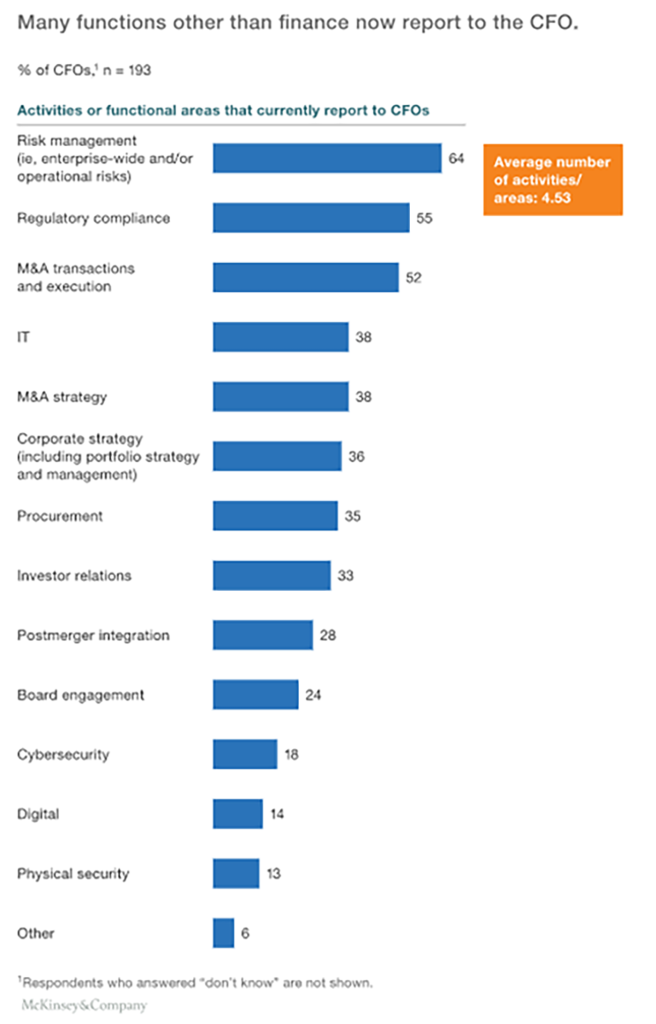

Here’s a tip. Educate yourself on how to have an informed conversation with someone responsible for ensuring the integrity of the corporate balance sheet. And before you react with, “Wait a minute. What about you? Shouldn’t you need to educate yourself about how a company ensures the integrity of customer relationships?”, just know that I have to possess a level of appreciation for the work of all the organizations in the company. I don’t profess to be an expert in data analytics or process design or even the sophistication of the skills required in order to excel at those things. But I think you might be persuaded to not make any assumptions about my company knowledge when you look at this graphic from McKinsey.

That graphic is a good one to illustrate why I place a bullseye on the threat of risk and why I also have a good grounding in the organizational effort required to really drive strong customer retention. In my mind, the two are inseparable. See the image below from The SaaS CFO Newsletter.

Or if that image fails to impress you, maybe this little discussion will. It’s from the same source and it’s about my role in ensuring the company understands liabilities when it comes to its future obligations. It’s one of the key metrics I take center stage with when I speak to the board and investors. Stuff like this matters to them and, need I say it… you too. The better the company performs, the stronger position you will find yourself in as you grow your career with us.

Let’s all agree that a fully functioning company requires all of its parts to work together in an optimal way. Working together naturally requires an appreciation for the type of value created by each business unit. I appreciate all the business units, including, but not more than any other, Customer Success.

Let’s do something bold. Let’s solve business challenges together.